Review of 2022, outlook for 2023

Expect a rough ride, but better returns

Dr Shane Oliver - Head of Investment Strategy and Chief Economist, AMP Capital

.

Key points

- 2022 was dominated by high inflation, rising interest rates, war in Ukraine & recession fears. This hit bonds & shares hard, driving losses for balanced growth super funds.

- 2023 is likely to remain volatile and a retest of 2022 lows for shares is a high risk. But easing inflation, central banks getting off the brakes (with the RBA at or close to the peak on rates), economic growth likely stronger than feared & improved valuations should make for better returns.

- Australian residential property prices likely have more downside, ahead of a September quarter low.

- The main things to keep an eye on are: inflation; central banks and interest rates; US politics; China tensions; and Australian residential property prices.

2022 – from Covid to inflation & surging interest rates

The good news is that 2022 finally saw the world shake off the grip of Coronavirus as it transitioned from a pandemic to endemic (albeit it’s still causing problems in China). However, the past year turned out far more difficult for investors than might have been thought a year ago:

- Inflation, which already rose in 2021 surged to levels not seen for decades, largely reflecting pandemic related distortions to supply and reopening & a stimulus driven surge in demand & floods in Australia.

- Russia invaded Ukraine, leading to a surge in energy & food prices.

- Central banks moved to aggressively withdraw monetary stimulus and raised interest rates at the fastest pace seen in decades to deal with inflation and rising inflation expectations.

- Bond yields surged in response to the rise in inflation & interest rates.

- Chinese growth fell sharply, reflecting its zero-Covid policy and a continuing property downturn despite policy stimulus.

- Geopolitical tensions surged with war in Ukraine and worries about a Chinese invasion of Taiwan following President Xi Jinping’s power consolidation, although there were hopes of a thaw near year end.

- As a result of all this, investors increasingly fretted about recession.

- Tech stocks and crypto currencies, having been the biggest winners of the Covid lockdowns & easy money, were hit hard by reopening and monetary tightening, ultimately proving no hedge against inflation.

Growth was still ok – but a lot weaker than expected

Despite these problems, global GDP is still expected to have come in at around 3.2% which is weaker than the 5% or so growth expected a year ago and down from 6% in 2021, but still reasonable as reopening and stimulus helped. And in Australia, GDP is expected to have been around 3.5%, lower than expected a year ago and down from 4.8% in 2021, but still reasonable. The growth slowdown saw a slowdown in profits. But the main problem for investment markets was the rise in inflation, interest rates and bond yields.

Investment returns for major asset classes

|

Total return %, pre fees and tax

|

2021 actual

|

2022* actual

|

2023 forecast

|

|

Global shares (in Aust dollars)

|

29.6

|

-7.4

|

4.0

|

|

Global shares (in local currency)

|

24.3

|

-11.9

|

7.0

|

|

Asian shares (in local currency)

|

-6.8

|

-18.0

|

10.0

|

|

Emerging mkt shares (local currency)

|

-0.2

|

-13.8

|

10.0

|

|

Australian shares

|

17.2

|

2.2

|

10.0

|

|

Global bonds (hedged into $A)

|

-1.5

|

-11.1

|

3.0

|

|

Australian bonds

|

-2.9

|

-7.8

|

4.0

|

|

Global real estate investment trusts

|

30.9

|

-23.0

|

9.0

|

|

Aust real estate investment trusts

|

26.1

|

-17.1

|

9.0

|

|

Unlisted non-res property, estimate

|

12.3

|

11.5

|

4.0

|

|

Unlisted infrastructure, estimate

|

12.0

|

10.0

|

5.0

|

|

Aust residential property, estimate

|

23.0

|

-7.0

|

-7.0

|

|

Cash

|

0.0

|

1.0

|

3.1

|

|

Avg balanced super fund, ex fees & tax

|

14.3

|

-3.0

|

6.3

|

Year to date to Nov. Source: Thomson Reuters, Morningstar, REIA, AMP

- Global shares had a rough year with a plunge of 23% into October on inflation, interest rate and recession worries, before a rally cut losses.

- Chinese shares led the weakness, not helped by its zero Covid policy, followed by Asian shares, given their exposure to China and cyclical sensitivity. US shares also underperformed reflecting its high-tech exposure & aggressive Fed tightening.

- Australian shares outperformed, helped by strong commodity prices and a relatively less hawkish RBA.

- Government bonds slumped as yields surged on high inflation & rate hikes. Australian bonds had their worst year since 1973 or the 1930s.

- Real estate investment trusts fell with the surge in bond yields.

- Unlisted property & infrastructure returns remained strong, being less sensitive to short-term share market and bond yield moves.

- Home prices fell sharply reflecting poor affordability after a boom &, particularly, as mortgage rates rose, reducing home buyer capacity.

- Cash and bank term deposit returns improved but were still low.

- The $A fell with share markets on growth concerns and relatively aggressive Fed rate hikes into October, before a partial recovery.

- Balanced super funds had negative returns reflecting poor share and bond returns. This followed very strong returns in 2021.

2023 – lower inflation and lower growth

First the bad news: inflation is still way too high at around 7 to 11% in many advanced countries; tight labour markets risk wage-price spirals; central banks are still warning of more rate hikes; the risk of recession is high with inverted yield curves and weak confidence largely in response to rate hikes; the US has returned to divided Government with the risk of debt ceiling and funding standoffs; war continues in Ukraine; and tensions remain with China and Iran. Even Covid continues to disrupt – but mainly in China as cases surge as it reopens. These all suggest another volatile year and possibly continuation of the bear market in global shares.

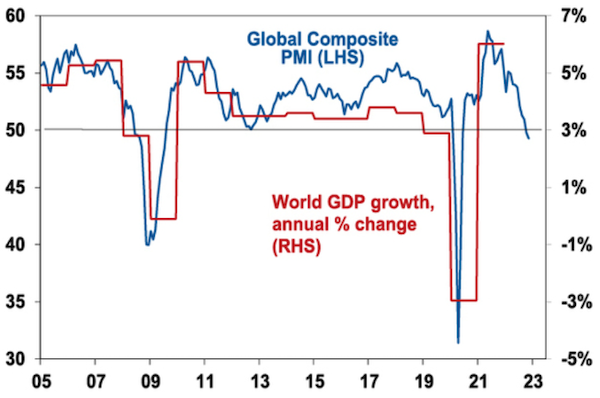

Global Composite PMI vs World GDP

PMIs are surveys of business confidence and conditions. Source: Bloomberg, IMF, AMP

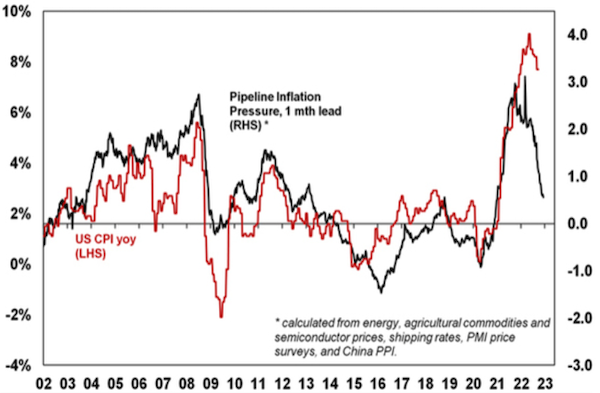

However, there is reason for optimism. First, inflationary pressures may have peaked and are slowing rapidly (as reflected in our Pipeline Inflation Indicator): supply chain pressures have eased; demand is cooling; and labour markets are showing signs of topping out. In fact, it may only require a slight pull back in demand (to push capacity utilisation back down to normal & unemployment above the NAIRU – or non-accelerating inflation rate of unemployment, with the return of immigration helping in Australia) to further depress inflationary pressure significantly. This suggests inflation could fall faster than central banks expect in 2023.

AMP Pipeline Inflation Indicator

Note that this is more a guide to direction than level. Source: Bloomberg, AMP

Second, central banks are likely nearing the peak in rates. The Fed is already moving to slow hikes, but conditions are likely to be soft enough to allow it to pause from around March ahead of rate cuts later in 2023. Sure, its signalling more but just as its signals were too dovish a year ago its signals now are likely too hawkish! In Australia, we see the RBA as being at or close to the top (3.1% is our base case for the peak with 3.35% our risk case) as by February/March conditions are likely to be weak enough to allow a pause, ahead of rate cuts in late 2023/early 2024.

Third, it seems everyone is talking about recession for 2023, such that it’s a consensus call. The risk is very high (probably over 50% in the US and Europe) and this will likely keep markets volatile given the threat to earnings. But it may not turn out to be as bad as feared.

- In the US it may just be a sharp slowdown or mild recession in 2023 – if the Fed starts to ease up on the brake soon and given the absence of other excesses that need to be unwound, eg, there has been no overinvestment in housing & capex and leverage is low.

- Europe has moved away from Russian gas very quickly and providing its winter is mild, may continue to hold up better than feared.

- Or lags in the way rate hikes impact may mean recession does not hit till 2024, meaning its too early for share markets to discount just yet.

- After initial Covid related setbacks, Chinese growth is likely to rebound in 2023 as it reopens. Just like occurred in other countries upon reopening (recall Australia’s Omicron disruptions earlier in 2022) China is likely to see a surge in cases initially. But markets are likely to largely look through this to the reopening boost ahead which will provide an offset to slower growth in the US and Europe.

- Australian growth is likely to slow but avoid recession, reflecting the less aggressive RBA, the pipeline of home building work yet to be completed and the strong business investment outlook.

Finally, geopolitics may not be so bad in 2023: there are no major elections in key countries in 2023; the war in Ukraine may not get any more threatening; and the Cold War with China may see a bit of a thaw.

Overall, global growth in 2023 is likely to be around 2.5%, well down from 6% in 2021, but not recession in aggregate. In Australia, growth is expected to slow to 1.5% in the year ahead. And inflation is likely to fall.

Implications for investors

Easing inflation pressures, central banks moving to get off the brakes, economic growth proving stronger than feared and improved valuations should make for better returns in 2023. But there are likely to be bumps on the way – particularly regarding recession risks – & this could involve a retest of 2022 lows or new lows in shares before the upswing resumes.

- Global shares are expected to return around 7%. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to remain a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples (17.5 times forward earnings in the US versus 12 times forward earnings for non-US shares). The $US is also likely to weaken which should benefit emerging and Asian shares.

- Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and ultimately stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%. Expect the ASX 200 to end 2023 at around 7,600.

- Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks become less hawkish.

- Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and higher bond yields (on valuations).

- Australian home prices are likely to fall further as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year as the RBA moves toward rate cuts.

- Cash and bank deposits are expected to provide returns of around 3%, reflecting the back up in interest rates through 2022.

- A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the now overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

What to watch?

The main things to keep an eye on in 2023 are as follows:

- Inflation – if it continues to rise, central banks will tighten more than we are allowing for risking deep recession.

- US politics – the return to divided government, with GOP controlling the House, runs the high risk of a return to brinkmanship around the debt ceiling, causing volatility in markets as we saw in 2011 and 2013.

- China issues – increased tensions around Taiwan are the main risk.

- An escalation of the Ukraine conflict could adversely impact Europe.

- Australian home prices – a sharper than expected fall as fixed rates reset and unemployment rises, could cause financial stability issues.

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.